Oriole Resources PLC (LON – ORR)

Oriole Resources PLC is an AIM-listed exploration company, operating in Africa and Europe.

Oriole is focused on early-stage exploration in Cameroon and the more advanced Senala gold project in Senegal, where IAMGOLD has the option to spend US$8m to earn a 70% interest. The Company has a number of interests and royalties in companies operating throughout Africa and Turkey and is assessing new opportunities in both regions.

Early-stage exploration in Cameroon

- First-mover advantage

- Cameroonian government promoting foreign investment

- Well-connected local partner

- Encouraging results across both licences – strongly supports further investment

- Actively building portfolio

News

-

Oversubscribed Placing to Raise £1.75 million, plus £20k Director Subscriptions (20 Sep 21)

Oriole Resources PLC (AIM: ORR), the AIM-quoted exploration company focussed on West Africa, is pleased to announce that it has conditionally raised £1.77 million before expenses (being £1.75 million in an oversubscribed placing and £0.02 million as subscriptions by certain Directors) (together, the ‘Placing’) through the issue of, in aggregate, 416,470,880 new ordinary shares (‘Placing Shares’) at a price of 0.425 pence per share (the ‘Placing Price’). The Placing Price is equal to the price of the Company’s ordinary shares at close of market on 17 September 2021. More

-

Corporate Update & Interim Results (1 Oct 20)

CEO, Tim Livesey, and CFO, Bob Smeeton, discuss the Interim Results including its progress in Senegal & Cameroon, Oriole’s asset realisation strategy, how the Company turned a profit and what to expect in the coming months – LINK

-

Oriole Resources posts a profit for the first half of the year (21 Sep 20)

Oriole Resources PLC (LON:ORR) Tim Livesey and Bob Smeeton talk to Proactive London about their interim results for the first half of 2020. MORE

-

Oriole Resources sells Turkish royalty for US$300,000 (17 Aug 20)

Oriole Resources PLC (LON:ORR) has signed a US$300,000 sale agreement with its joint venture partner Anadolu Export Maden Sanayi ve Ticaret Ltd Şirketi in relation to the Karaağac mining royalty in Turkey. MORE.

-

Moving towards drilling in Cameroon as new campaign gets underway in Senegal (30 Jun 20)

Oriole Resources PLC‘s (LON:ORR) Tim Livesey speaks to Proactive London’s Andrew Scott following the news they’ve raised £419,500 to support ongoing exploration at the company’s projects in Cameroon – including moving the programme at Bibemi towards drill mobilisation later this year.

Livesey also updates as a 10,000 metre air core drilling campaign gets underway at the Faré target on its Senala project in Senegal, where joint venture partner IAMGOLD Corporation has the option to spend up to US$8mln to earn a 70% interest. LINK

-

Oriole Resources hails progress on Djibouti projects (25 Jun 20)

Oriole Resources PLC‘s (LON:ORR) Tim Livesey caught up with Proactive London’s Andrew Scott following the news its subsidiary, Thani Stratex Djibouti Ltd, has secured US$2.5mln in investment from American Minerals Exploration & Development Fund III.

The cash will be used to fund exploration in Djibouti, in particular the Oklila and Hesdaba epithermal gold projects. LINK

Projects

CAMEROON

The Country

The Cameroon Government are prioritising the development of the mining sector. Highlighting efforts:

- World Bank funded PRECASEM programme launched in 2012 to gather countrywide geological data, in association with BRGM, GTK and local geological services group, BEIG3, aiming to encourage foreign investment into the mining sector.

- PRECASEM Phase 1 data announced September 2019 driving further foreign investment.

- Favourable mining code published in 2016:

- 5% precious metals royalty.

- 30% corporate tax.

- 10% government free carry. Right to acquire an additional 10%.

- Exploration licence (up to 500km sq) valid for 7 years (initial 3 years and renewable twice for 2 years each).

Projects

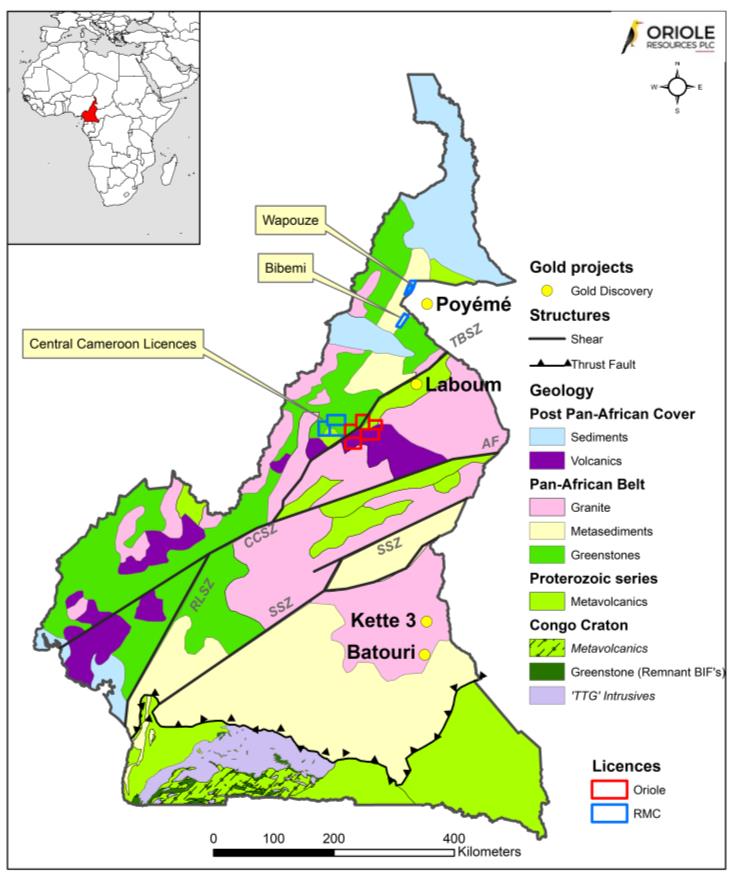

Bibemi and Wapouzé are early-stage gold exploration projects, covering highly prospective Neoproterozoic Pan-African greenstone belts in north-eastern Cameroon. Oriole has the option to earn a 90% interest by spending US$3.12m.

The Company’s interests in the projects are held 100% by local company BEIG3 through its wholly-owned subsidiary, RMC Cameroon SARL, formerly held in JV with Reservoir Minerals Corporation. The majority of work to date has been completed at the Bibemi licence – MORE. Year 2 expenditure commitment met at both projects.

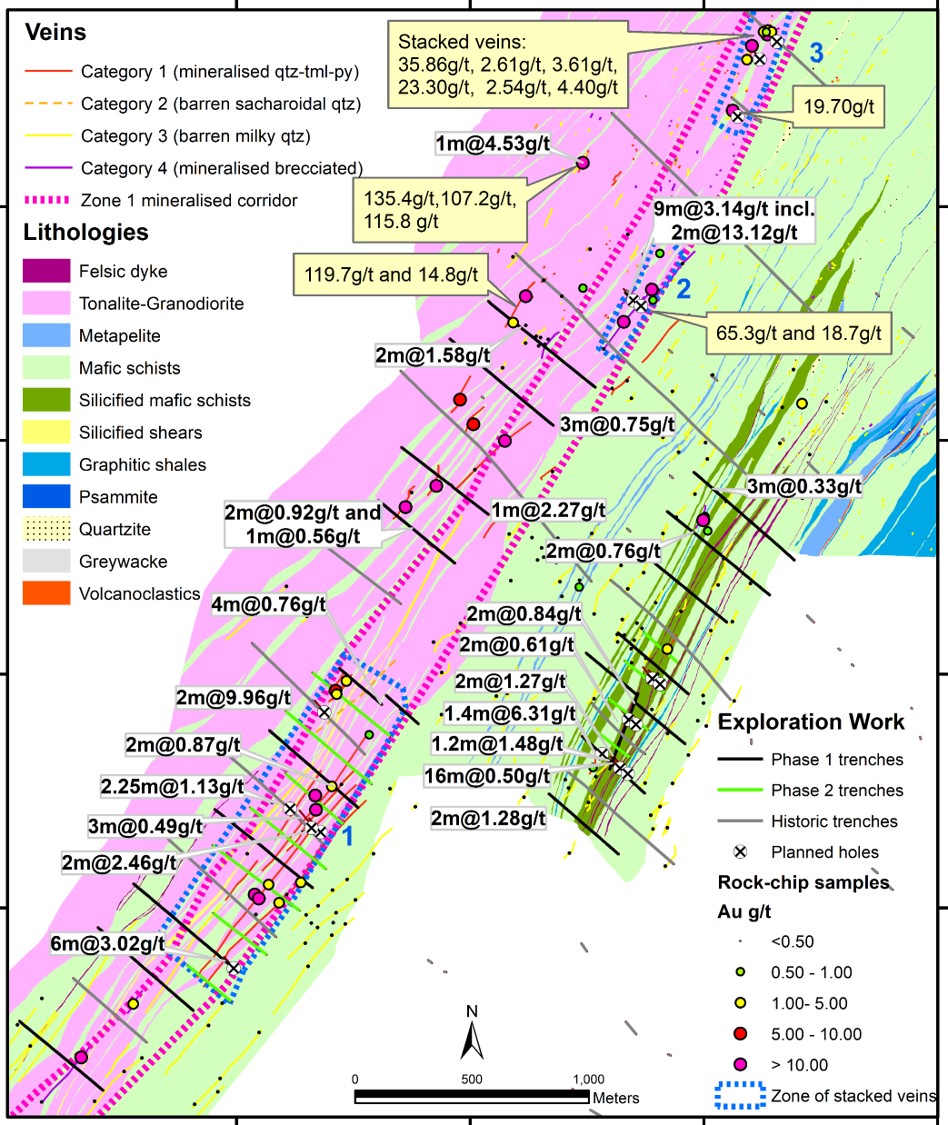

- 12,500m trenching completed over 2 key zones.

- Results, up to 9m @ 3.14 g/t Au, have confirmed multiple zones of orogenic type gold mineralisation over a 5km long central zone.

- Evidence of stacked systems could suggest potential for enhanced volumes of mineralisation.

- Zone 1 mineralised corridor extends over 5km open along strike.

- System remains open along strike.

- Planned work programme for 2020:

- Drilling programme designed for an initial 2,000m of an anticipated larger programme.

- Majority of holes already pegged minimal preparation works required ahead of drilling.

- Drilling anticipated to commence in Q4-2020, subject to ongoing developments related to COVID-19.

- Team to undertake further detailed mapping of the northern Bakassi Zone during 2020 with the aim of extending the maiden drill programme to 3,000m.

- Reconnaissance mapping along strike to the southwest also planned.

- JORC Table – LINK

Cameroon – Geology

|

Bibemi – Drill Plan

|

- Detailed geological mapping and soil sampling identified two key zones cumulative strike of over 13 km at the Bataol Zone is primary target for follow up

- Planned future work programme:

- At the Bataol Zone, initial results (up to 531 ppb Au) identified three main zones of NE trending mineralisation (>10 ppb Au).

- Infill soil sampling (200m x 100m) defined zones of higher grade anomalism including 1km x 300m grading >60 ppb Au 1.

- A targeted trenching programme is being planned to follow up on the most significant anomalies at Bataol.

- JORC Table – LINK

Wapouzé – Phase 1 soil geochem

|

Wapouzé – Phase 1 and 2 soil geochem

|

- 8 new licences under application in central Cameroon:

- 3 through the Company’s existing partnership with BEIG3 (via BEIG3’s wholly owned subsidiary RMC

Cameroon). - 5 through new local subsidiary Oriole Cameroon SARL (90% owned).

- 3 through the Company’s existing partnership with BEIG3 (via BEIG3’s wholly owned subsidiary RMC

- Contiguous land package covering c. 3,500km sq

- Licences selected on basis of geological and structural setting and known gold anomalism.

- Recent PRESCAEM maps confirm multiple (regional scale) gold in stream anomalies on each of the licences significant potential for district scale gold mineralisation.

- Initial work programme will include remote sensing targeting, mapping and infill stream sediment sampling over the priority target areas.

SENEGAL

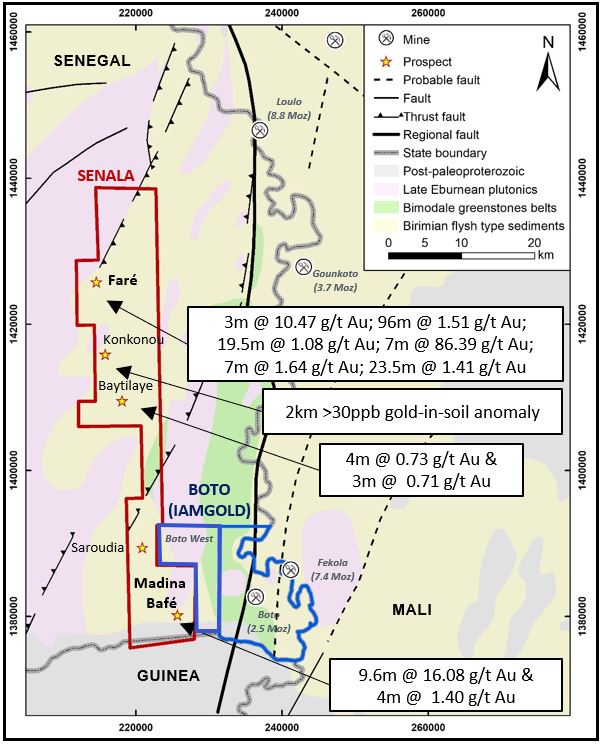

Located in south-eastern Senegal, the 472.5 km sq Senala licence is positioned in the centre of the Birimian-age Kédougou-Kenieba gold belt that extends from eastern Senegal into western Mali and has already seen multiple major gold discoveries including Terranga’s Massawa (3.4 million oz Au) and Sabodala deposits (3 million oz Au) in Senegal, and Barrick’s Loulo (12 million oz Au) and Gounkoto projects (5.76 million oz Au) in Mali. IAMGOLD has the option to earn a 70% interest by spending US$8m.

Senegal – Licences

|

Faré – Drill Plan

|

The Company own 85% of Senala (formerly known as Dalafin) through its Senegal-registered joint-venture company Stratex EMC S.A., formed in partnership with private local company Energy & Mining Corporation S.A. (EMC) that holds the remaining 15%.

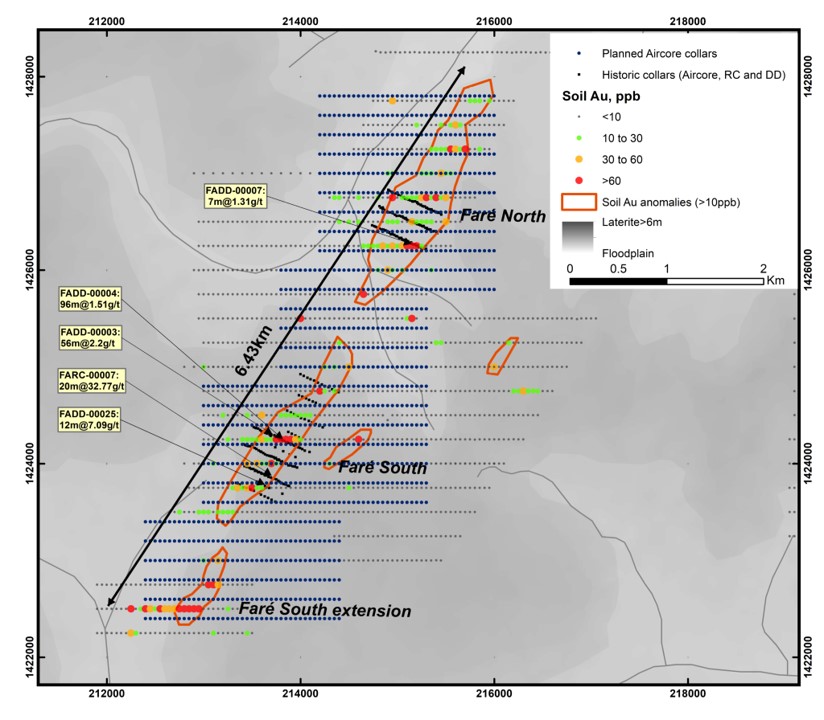

To date, four main geochemical targets, Faré, Baytilaye, Saroudia, and Madina Bafé, have been confirmed by drilling. MORE

- As of March 2018, IAMGOLD is spending US$4M on exploration over 4 years to acquire 51% option to increase to 70% for further US$4M over 2 years.

- Year 2 programme progressed well with work focused on southernmost targets, closest to IAMGOLD’s 2.5Moz Boto gold development project:

- 4,167m AC drilling at Madina Bafé identified multiple further gold anomalies extending over multiple kilometres.

- 3,158m AC drilling at Saroudia also completed.

- Historical drilling returned several ore grade intersections within 200m of surface. Company believes there is potential for a stand alone, open pittable deposit at Faré.

- A 10,000m AC drilling programme currently underway at Faré as part of IAMGOLD’s Year 3 earn-in.

Other Interests

TURKEY

- Anadolu – Oriole has a 1.5% NSR royalty on any future mineral production at its former Karaağac gold project in Turkey, now operated by Anadolu. MORE

- Lodos – Oriole has a 1.2% post-Turkish tax royalty on its former Muratdere copper-gold porphyry project in Turkey, now operated by Lodos. MORE

- Bati Toroslar – Bati Toroslar is funding exploration at the Hasançelebi and Doğala licences in Turkey and will pay Oriole US$0.5M if a minimum JORC-compliant Indicated or Measured gold resource of 100,000 oz (0.3 g/t cut off) is defined within the oxide and transition zones at Hasançelebi. Oriole will receive a 1.5% NSR royalty on future precious metals production at the licences, and a 5% NSR on future production of other metals or industrial raw minerals. MORE

DJIBOUTI

Oriole has a 11.8% interest in privately-owned Thani Stratex Djibouti Limited (‘TSD’) for its projects in Djibouti. TSD is currently focused on the Oklila (Pandora), Hesdaba and Assaleyta licences. In November 2018, TSD signed an agreement with African Minerals Exploration & Development Fund III for the management and funding of TSD. The first US$2.5 million tranche of the funding has been used to undertake drilling programmes at Pandora and Hesdaba. Further tranches will be advanced subject to TSD achieving performance milestones, including resource definition and the completion of technical studies.

- Pandora – The 93 km sq Oklila licence includes the main Pandora epithermal vein target (comprising Pandora and Pandora South prospects) which is up to 15 metres wide at surface and can be traced over a strike length of approximately 2 km. Grades vary from 5ppb Au to 54.5g/t Au. Located 250 metres SW of the main Pandora structure, the Pyrrha Vein has been identified over a strike length of 1.5 km. The vein is generally less than 1 m in thickness. High gold assays of up to 71.60 g/t Au at surface could indicate a potential for the presence of high gold grades at depth. Further mapping in the area has also discovered the Thyia Zone which appears to be a linkage structure between Pyrrha and Pandora. The entire system at Oklila comprises over 10 km strike of outcropping and inferred veins. MORE

- Hesdaba – At the recently-acquired Hesdaba project, 10 km northwest of Pandora, TSD has completed detailed mapping that has identified veins over a combined strike of 16 km. Phase 1 drilling has recently been completed to test the epithermal system at depth. Results are anticipated in Q3-2020. MORE

- Assaleyta – Located c.16 km to the North of Pandora, low-sulphidation epithermal gold occurs as high-grade veins and disseminated mineralisation in rhyolite domes. Phase 1 exploration by Thani Stratex during Q2-2015 comprised 303 samples (126 grab and 177 chip samples across 13 channels) and 1:2,000 mapping across the sample areas. Channel sampling returned best values of 19 m @ 4 g/t Au and 6 m @ 10 g/t Au (600 m apart), and five selective grab samples assayed >20 g/t Au (highest grade of 41 g/t Au). In 2016, a maiden drilling programme was completed across the three main prospects, Porcupine Hill, Red Eagle Mountain and Black Mamba. The drilling confirmed vertical continuity of the system to a depth of at least 175 m and returned best intercepts of 17.38 m @ 2.25 g/t Au from surface (AY-DD-01) and 1.58 m @ 8.67 g/t Au from 177.19 m (AY-DD-03). MORE

EGYPT

Oriole has a 26.1% interest in privately-owned Thani Stratex Resources Limited (‘TSR’) for its projects in Egypt, both located in the Hodine licence:

- Hutite – Former operator Thani Ashanti drilled over 30,000 metres of RC and diamond drilling between December 2010 and March 2013. On the basis of this work, South Africa-based Quantitative Group estimated an Inferred Resource (non-JORC) of 11,410,000 tonnes grading 1.41 g/t Au for 520,000 in-situ ounces using 0.4 g/t Au cut-off.

- Anbat – The Anbat-Shakoosh district, located within a 15 km-long belt to the south of Hutite, hosts broad zones of near-surface gold mineralisation within steeply-dipping, silicified (and sulphide-rich) felsic dikes as well as more shallow-dipping sheeted veining within an adjacent granitic unit. The district currently hosts three prospects: North Anbat, Anbat and Shakoosh. Anbat and, to a lesser extent, Shakoosh have been the main focus of exploration to date. In December 2017, TSR announced a maiden Inferred Mineral Resource Estimate of 209,000 oz at 1.11 g/t Au within porphyry sills. MORE

Directors and Management

-

John McGloin - Non-Executive Chairman

John McGloin is a geologist and graduate of Camborne School of Mines. John worked for many years in Africa within the mining industry before moving into consultancy. He joined Arbuthnot Banking Group following four years at Evolution Securities as their mining analyst. He is also the former Head of Mining at Collins Stewart. More recently, John served as the Chairman and Chief Executive Officer of Amara Mining plc until 2016 when it was sold for US$85 m. He is currently a non-executive director to Caledonia Mining Corporation plc and to Perseus Mining Limited. LinkedIn

-

Tim Livesey - Chief Executive Officer

Tim has 28 years’ experience in gold and base metals, with a distinct focus on Africa, Europe and Asia. He has worked at all stages of exploration, development and mining, and has a strong track record of delivery, both at the technical and commercial level within previous positions. Some of his more notable roles to date include exploration manager (Eurasia), Barrick Gold Corp., project director and later CEO of Tethyan Copper Company Pty Ltd (a Joint Venture between Antofagasta Minerals and Barrick Gold Corp, owner of the Reko Diq project in Pakistan), and more recently as COO of TSX.V-listed Reservoir Minerals Inc., which was sold in June 2016 to TSX-listed Nevsun Resources Ltd for US$365 million. Tim joined the company in March 2018. LinkedIn

-

Bob Smeeton - Chief Financial Officer

Bob is a member of the Institute of Chartered Accountants in England and Wales. He trained as a chartered accountant with Price Waterhouse, qualifying in 1992, and has a BSc in geography from Durham University. Bob has extensive experience of working for AIM-quoted companies, where he has been heavily involved in turnaround situations, fund raisings and acquisitions.

In partnership with three different CEO’s, Bob was instrumental in the turnaround and subsequent growth of AIM-listed Universe Group Plc as Group Finance Director, seeing its market capitalisation increase from £1.5m to £25m during his tenure.

Prior to the Universe Group, Bob was European Finance Director for OpSec Security Limited, where was heavily involved in formulating and implementing a very successful reconstruction plan. The restructuring plan stemmed the annual operating losses of £2.5million and moved the Company to a profit situation in the first year of its implementation. LinkedIn

-

David Pelham - Independent Non-Executive Director

David Pelham is a mineral geologist with over 35 years global exploration experience. He has overseen the discovery and early evaluation of multiple deposits, most notably including the +6 Moz Chirano Gold Mine in Ghana, as well as Hummingbird’s 4.2 Moz Dugbe gold deposit in Liberia. David has been a non-executive director to AIM-quoted Cora Gold Ltd since May 2017. LinkedIn

-

Claire Bay - VP Exploration & Business Development

A Chartered geologist with over ten years’ experience in the resources sector, Claire graduated from the University of Southampton with a First Class Masters in 2007 and joined AIM-listed Stratex International shortly thereafter, where she spent the next 11 years. During her career, Claire has operated at both the technical and commercial level, with a particular focus on gold exploration in Africa and Turkey. In addition to managing the Company’s business development activities, Claire also oversees the Company’s exploration programmes and is heavily involved in the review and interpretation of technical data. LinkedIn

-

Bahri Yildiz - General Manager Turkey

Bahri Yildiz is a Turkish national with an industrial career spanning more than 30 years dedicated to mineral exploration and mining geology throughout Turkey. A geology graduate of the Middle East Technical University, Bahri commenced his career in 1980 with the government’s General Directorate of Mineral Research and Exploration (MTA) where he spent ten years managing a wide range of projects relating to exploration for precious and base metals. This was followed by three years as Exploration Manager with Turkish company Yurttaslar Madencilik before he joined Dardanel Madencilik, the Turkish subsidiary of major Canadian mining company Inco Ltd in 1992 as Senior Geologist. During his final four years with Dardanel he was Exploration Manager and responsible for generating and supervising a wide range of exploration programmes throughout Turkey. Following closure of the Turkish office in 2003 he became an independent consultant before joining Stratex in April 2005. LinkedIn

-

Abdoul Mbodji - Exploration Manager - Cameroon

A Senegalese national, Abdoul has ten years’ experience in mining and exploration geology. After completing a degree in Geosciences and a Master’s in Natural Sciences, both from the University of Dakar, Abdoul started his career as a junior geologist at Terranga Gold’s Sabodala gold mine. Abdoul subsequently joined Silvrex Limited, which was acquired by the Company’s subsidiary, Stratex West Africa, in 2012. As Project Geologist and then Senior Geologist for Stratex West Africa, Abdoul has worked on gold and base metal projects in Mauritania and the Senala (formerly Dalafin) gold project in Senegal, now under JV with IAMGOLD. Abdoul is experienced in all aspects of exploration, including planning, executing and supervising field work, management of the technical database and QAQC protocols, and liasing with the local administration. In 2019, Abdoul joined Oriole at top-company level and was promoted to Exploration Manager of Cameroon where he is currently responsible for generating and supervising exploration activities in country. LinkedIn